salt tax cap married filing jointly

It is available through the 2025 tax year. Doing my taxes on turbotax and it first determined I should take standard deduction for married filing jointly as I expected.

Home Ownership Matters 3 Key Changes For Homeowners Under The New Tax Law Key Change Homeowner Change

The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately.

. Salt cap of 10000. The cap reverts back to 10000 for 2031 the final year it would be in effect. Press question mark to learn the rest of the keyboard shortcuts.

First it would raise the cap from 10000 10000 for married couples filing jointly to 15000 30000 married couples filing jointly. These deductions were unlimited. Ad So you need to file a tax return every year.

Tax software designed just for you. Press J to jump to the feed. The SALT workaround is an option for the 2021 tax year.

Pdf introduction some lawmakers are seeking to repeal the 10000 cap for single and married couples jointly filing on state and local tax salt deductions put in place under the tax cuts and jobs act tcja. The Tax Cuts and Jobs Act limited the SALT deduction to 10000 for individuals and MFJ married filing jointly significantly increasing taxpayers effective tax rate. House passes legislation to repeal salt deduction cap for two years focus turns to senate efforts.

We will help you with that. Tax software designed just for you. It also aims to double the SALT deduction to 20000 for married couples filing jointly in 2019.

Second it would adjust the cap for inflation each year. As a side note it is a 10000 limit. In late December 2019 the US.

5377 which calls for the removal of the SALT deduction cap for the 2020 and 2021 tax years. Filing Status 2017 Standard Deduction Amount 2021 Standard Deduction Amount Single Married Filing Separately 6350 12550 Married Filing Jointly Qualifying Widow 12700 25100 Head of Household 9350 18800 What is the SALT Deduction. By limiting the SALT deduction available to certain taxpayers the SALT cap decreases the tax savings associated with the deduction relative to prior law thereby increasing federal revenues.

In the spirit of mitigating the marriage. Ad So you need to file a tax return every year. Is it 5000 for Married Filing Separately.

New tax law for 2018. While the TCJA included some tax provisions that reduced the married tax penalty as stated above the 10000 SALT limit increases tax on married taxpayers filing jointly. In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and.

The bill landed in front of the US. This limit applies to single filers joint filers and heads of household. When does Californias SALT pass-through workaround start.

We will help you with that. The arrival of the TCJA meant that the standard deduction amount was increased which reduced the number of taxpayers eligible to have deductions and capped the overall SALT deduction at 10000. It is 10000 for all other filing statuses.

House of Representatives passed the Restoring Tax Fairness for States and Localities Act HR. While the standard deduction for married couples filing jointly is twice the standard deduction of single taxpayers the tjca limited the itemized deduction for state and local taxes salt to 10000 for both single taxpayers and. Log In Sign Up.

By the text below if the fed salt cap irc sec 164 b 6 is. The marriage penalty has long been considered an unfair tax that results in a higher tax burden solely based on marital status. As of 2019 the maximum SALT deduction is 10000.

The proposal also addresses an unfair marriage penalty where two single filers could each claim a 10000 SALT deduction but once they marry and file. The deduction has a cap of 5000 if your filing status is married filing separately. With recent tax reform a lot of folks are talking about it.

Salt tax cap married filing jointly. It is 5000 for married taxpayers filing separately. Under TCJA the SALT deduction was capped at 10000 for single filers and married couples filing jointly.

It is 10000 for all other filing statuses. Under current policy the SALT deduction cap is not adjusted for inflation. Is this the same number for single married filing jointly and married filing singly.

The increase to the standard deduction under TCJA resulted in more taxpayers claiming the standard deduction rather than itemizing. Then towards the end. We estimate that the proposal to raise the SALT.

Salt tax cap still.

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Khabar The Major 2018 Federal Tax Changes

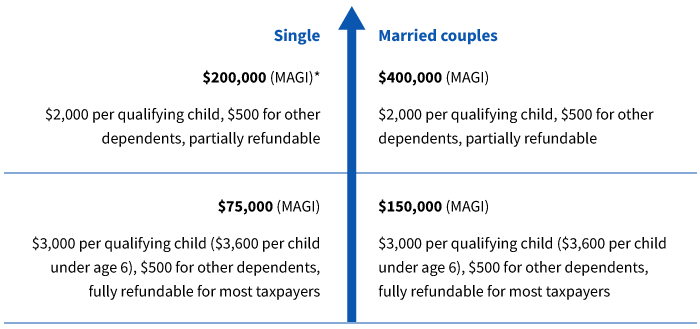

New Child Tax Credit Form Coming For The 2021 Filing Putnam Wealth Management

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

How The Tcja Tax Law Affects Your Personal Finances

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Here S When Married Filing Separately Makes Sense Tax Experts Say

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Ask The Tax Genius Married Filing Jointly Vs Separately Policygenius

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy